Are you investing regularly in an Index fund (S&P 100, S&P 500) or any other? Here is a simple-to-follow trick on how to beat AIP returns with manual investments.

Regular investors can easily beat the AIP returns on Index funds by making the same investment manually in their choice of funds and all this with no advanced technical knowledge and no paid tools. This trick can work wonder if your investment objectives are the following:

- If you invest regularly in a fund or stock with the intention of holding it for the long term.

- If you are looking to invest on a regular basis and no skipping.

- If you are looking to invest on monthly basis in small portions.

Let’s get to it, for the case study we would take the example of the S&P 100 index fund. If you are new to investing, here are a quick few terms that are good to know.

Table of Contents

What is an Index fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a particular market index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds are passively managed, meaning that they do not seek to outperform the index they track, but rather to replicate its performance as closely as possible.

Index funds typically have a diversified portfolio of securities that reflects the composition of the underlying index. For example, I like to invest in S&P 100 instead of S&P 500 index fund would hold a more refined collection of stocks that represents the top 100 companies in the S&P 500 index. By investing in an index fund, investors can gain exposure to a broad range of securities in a particular market or sector, without the need to actively select individual stocks or bonds.

Index funds are often recommended as they are a low-cost investment option, as they tend to have lower expense ratios than actively managed funds. So you don’t have to actively manage them.

What is an AIP (Automatic Investment Plan)?

An automatic investment plan (AIP) is a way to invest money regularly, without having to make manual investments each time. With an AIP, you set up a schedule for making investments, and the investments are automatically made for you at specified intervals. For example, you might set up an AIP to invest a certain amount of money into a mutual fund or exchange-traded fund (ETF) every month.

There are several benefits to using an AIP:

- Consistency: An AIP can help you maintain a consistent investment plan, even if you don’t have time to make investments manually on a regular basis.

- Dollar-cost averaging: By investing a fixed amount of money at regular intervals, you can potentially reduce the impact of market volatility on your investments. This is known as dollar-cost averaging.

- Convenience: An AIP allows you to set it and forget it, making it a convenient way to invest.

To set up an AIP, you will typically need to open an investment account with a financial institution or brokerage firm and choose the investment products that you want to include in your AIP. You will then specify the amount of money you want to invest and the frequency of your investments. The investment provider will handle the rest, automatically investing your money according to your schedule.

Can I beat returns on my AIP by making the same investment (same amount, same fund) manually?

Yes, and quite easily. To do this, we are going to use the technical indicator RSI.

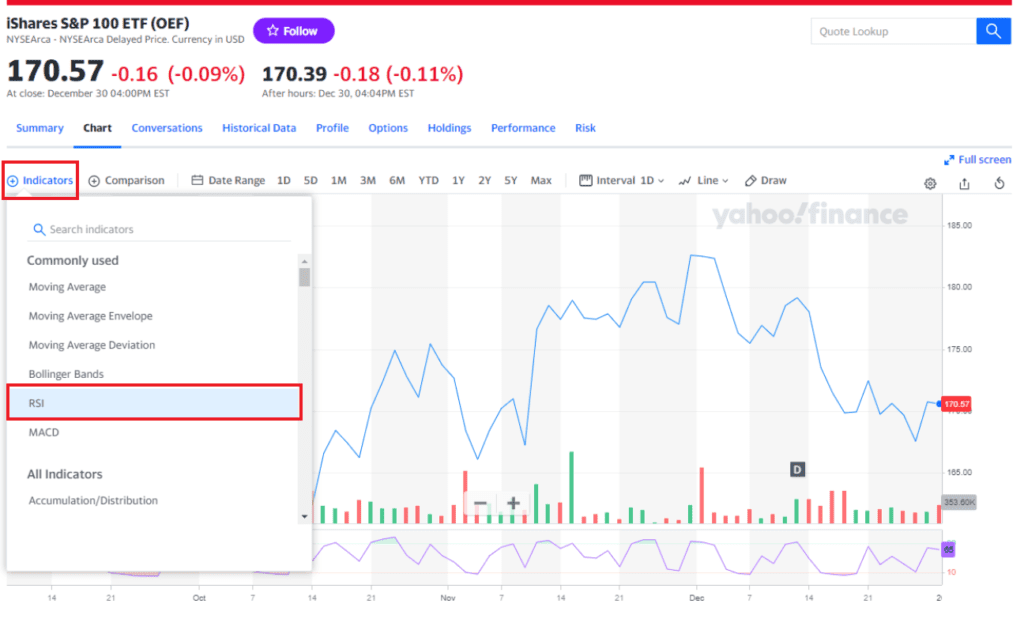

- Go to yahoo finance and select the fund of your choice. I have selected iShares S&P 100 ETF (OEF) for reference.

- Set the price interval to 1 day.

- Click on + Indicator and add RSI.

The relative Strength Index (RSI) is a technical analysis indicator that measures the strength of a security’s price action. It is a momentum oscillator that compares the magnitude of recent gains to recent losses in an effort to determine overbought and oversold conditions.

The RSI is calculated using a formula that divides the average gain of a security over a specific period by the average loss over the same period. The resulting value is then plotted on a scale from 0 to 100, with a value of 70 or above indicating that a security is overbought, and a value of 30 or below indicating that it is oversold.

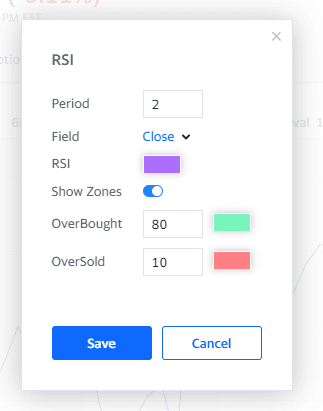

IMPORTANT: For our analysis, we need to change the Oversold value to 10 instead of 30. While adding RSI change the Period value to 2 and change the oversold limit to 10.

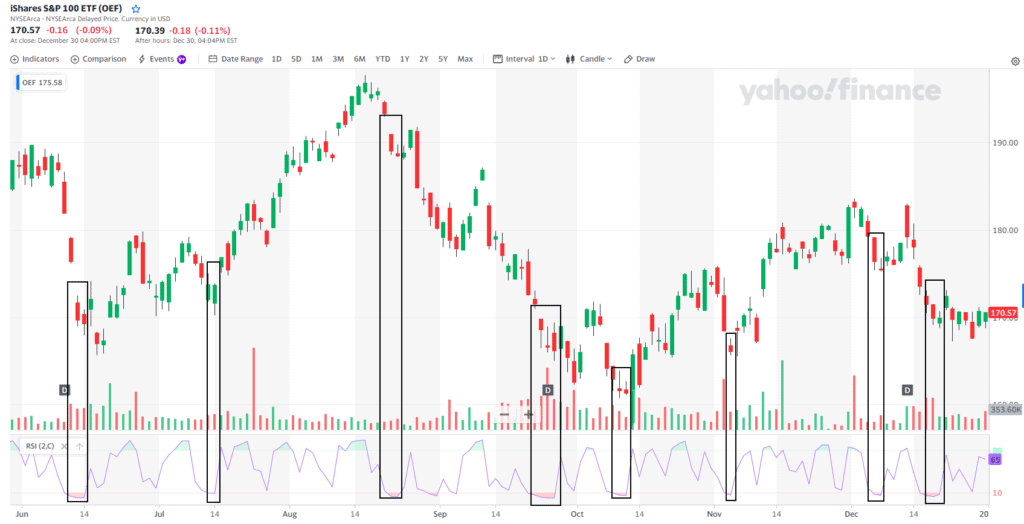

Now you can observe, that using this setup the investor will be able to identify dates on which investments will yield more than optimum results. Observe the days where the Price dips (usually denoted with a red candle) and RSI touches the red line (oversold line).

These are optimum investment points when you can park your monthly investment in the fund of your choice. The good thing with this setup is you will notice that there are usually not more than one or two instances in a month, where the buying opportunity will surface. So they become the optimum entry points for your investment.

Will there be too many entry points in a month or how to choose the best (lowest) one?

No, on average you will notice in an upside or stable market, investors will notice mostly one or two entry points. The general rule is to make an investment in the first one. And if you have a surplus you can make some additional investment in the second one.

Does it work in the short run?

There are better strategies to go after in the short run, this is advisable for long-term investors not willing to spend too much time and want to make an aware decision without getting too technical.

Will it work in any market?

Yes, this strategy is market agnostic. Go for any market any fund.

Side note: If you want to know more about RSI investing tricks, here is a simple and quick video that can help.

Author’s note: We intend to make readers aware of early investing ideas through our research and make them aware of potential investment opportunities. Please perform due diligence before investing your hard-earned money. We hope this article will help in the research.

We have more innovating investing ideas on our platform, be sure to check it out.

+ There are no comments

Add yours